Building for the Next User — Autonomous Agents

2025-05-30T21:24:04

Economic Infrastructure for Autonomous AI Agents: Trust, Payments, and Autonomy

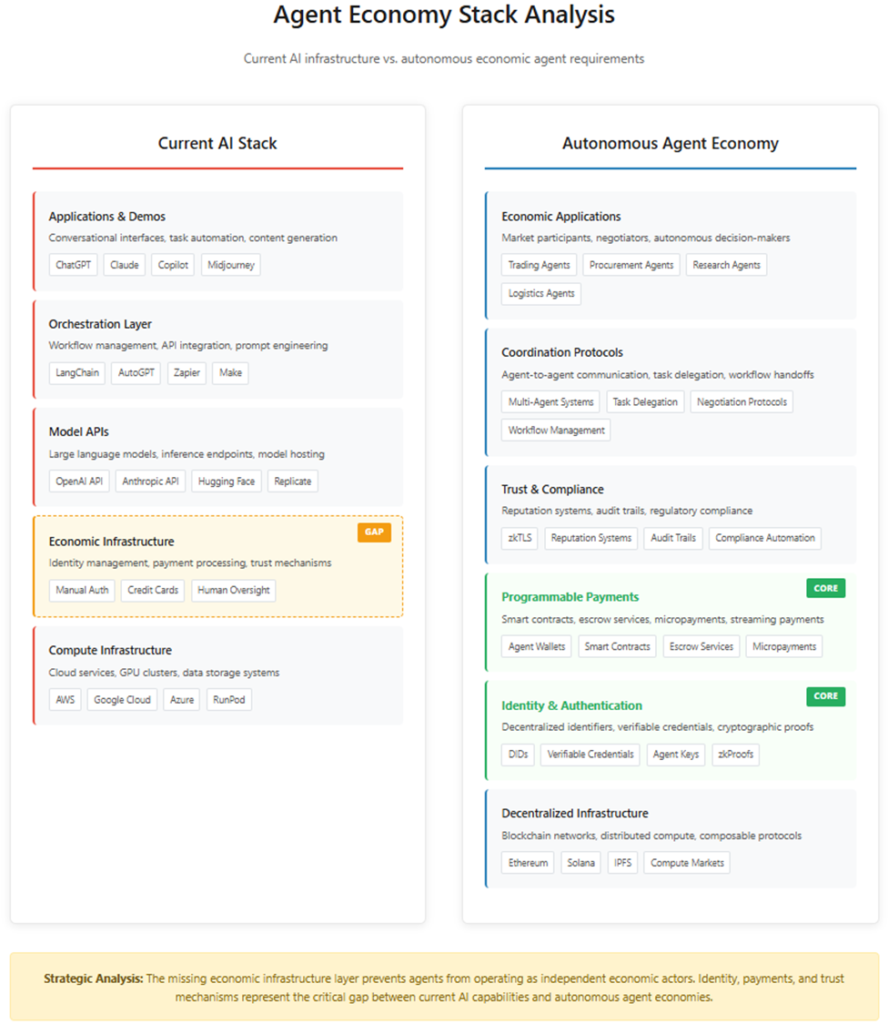

Agents are the next users of the internet. To support them, we must build identity, trust, and programmable payments into the stack.

Beyond the Hype: Why Most AI Agents Can’t Actually Act

This isn’t another AI agent blog post.

You’ve already seen the AI Agent 101s, stack diagrams. The market landscapes. The breathless threads about how agents will change everything. Meanwhile, half the industry is just wrapping ChatGPT in a for-loop and calling it “autonomous.”

I’m not here to talk about orchestration frameworks or prompt chains.

I’m here to talk about agents that can hold assets, make decisions, transact, and coordinate on behalf of people, organizations, and even other agents. Not demos. Not wrappers. Real economic actors. Real autonomous agents.

I’ve been watching demos for months. Every week, another “breakthrough” agent that can book flights or summarize emails. Cool. Another action model. But can it hold $50k in escrow? Can it verify a supplier’s credentials? Can it negotiate terms with another agent without human oversight?

The next users of the internet won’t be human. They’ll be autonomous agents that reason, plan, and act independently. They won’t just answer prompts or generate content, they’ll bid in markets, negotiate deals, execute contracts, and participate in the economy.

But right now, most of them are just useless toys and crypto memes. They demo well on Twitter. They can hit APIs or call smart contracts, but they can’t be trusted. They lack identity. They lack a reputation. They ignore compliance. They have no policy enforcement.

They can think, but they can’t act. And if they can’t act, they can’t be autonomous.

Forget building another framework. Start by asking: Can this agent actually hold value, follow rules, and be trusted with real-world tasks?

What Made This Shift Possible

Until recently, agents were mainly theoretical. They required brittle, rules-based programming or narrow training that didn’t generalize. However, 2024 brought about significant changes, with several breakthroughs making a profound impact.

Multimodal LLMs like GPT-4o suddenly made real-time reasoning viable, while shrinking model footprints meant you could run powerful models on laptops and phones. Meanwhile, frameworks like Kite.ai and LangChain made multi-agent coordination accessible to any developer, and cheap compute from decentralized providers meant agents could spin up tasks and rent GPUs on demand.

The tech was already here. But this shift was real and urgent when Google made their major announcement at I/O. Google has finally taken the gloves off in the AI race/battle.

Google’s I/O 2025 made one thing clear: agents aren’t speculative anymore. They’re productized, prioritized, and here. Project Mariner introduced agents that act across the web. Gemini 2.5 Pro adds deep task planning. Astra enables real-time multimodal perception. Jules automates developer workflows. This is a full-stack agent ecosystem running across Chrome, Gmail, Android, and Cloud — and it’s locked behind a $249/month AI Ultra subscription.

These aren’t just smarter assistants. They’re the start of a new architecture — where agents navigate APIs, trigger workflows, and act on behalf of users. However, that vision only works if the necessary infrastructure exists to support it: identity, policy enforcement, and verifiable execution. Google owns the entire stack — models, interface, data, and coordination layer. That’s not just agent deployment. That’s agent centralization.

If we don’t build open alternatives now — identity, wallets, payments, trust — we won’t just lose the interface. We’ll lose the economy built on top of it.

But here are a few questions: if agents are going to shape how we use the internet, who controls them? Who validates them? Who authorizes them? Who is responsible for them?

That’s why we need an open alternative, a programmable, permissionless, decentralized agent infrastructure. Not for demos. For the world.

This isn’t another agent stack. I’m not talking about tools that chain LLMs or orchestrate APIs. I’m talking about economic agents, autonomous software that can hold wallets, enforce policy, exchange value, and operate in adversarial environments. That requires identity, payments, and trust. Without those primitives, agents can’t participate in real-world systems.

Why Agents Matter Now

The capability is finally there. Models (foundational) are no longer the problem. The technical capability exists. But autonomy isn’t just about intelligence. It requires infrastructure.

Without infrastructure, agents remain disconnected from systems of accountability, compliance, and value exchange. To move from experiments to real-world actors, they need a stack to authenticate, coordinate, transact, and enforce rules of engagement.

What’s Holding Agents Back

What’s missing? Today’s agent landscape is fragmented and underpowered.

The majority of blockchain agents remain gimmicky token wrappers on chatbots, offering no meaningful autonomy and being functionally useless. Meanwhile, LLM stacks focus on cognition rather than action, optimizing prompts instead of workflows. Payments still route through centralized APIs, which lack programmability and native support for autonomous actors. Identity and reputation systems are absent or siloed, making trust and compliance nearly impossible. Agent interactions assume cooperation, rather than adversarial behavior, and overlook environments with partial trust.

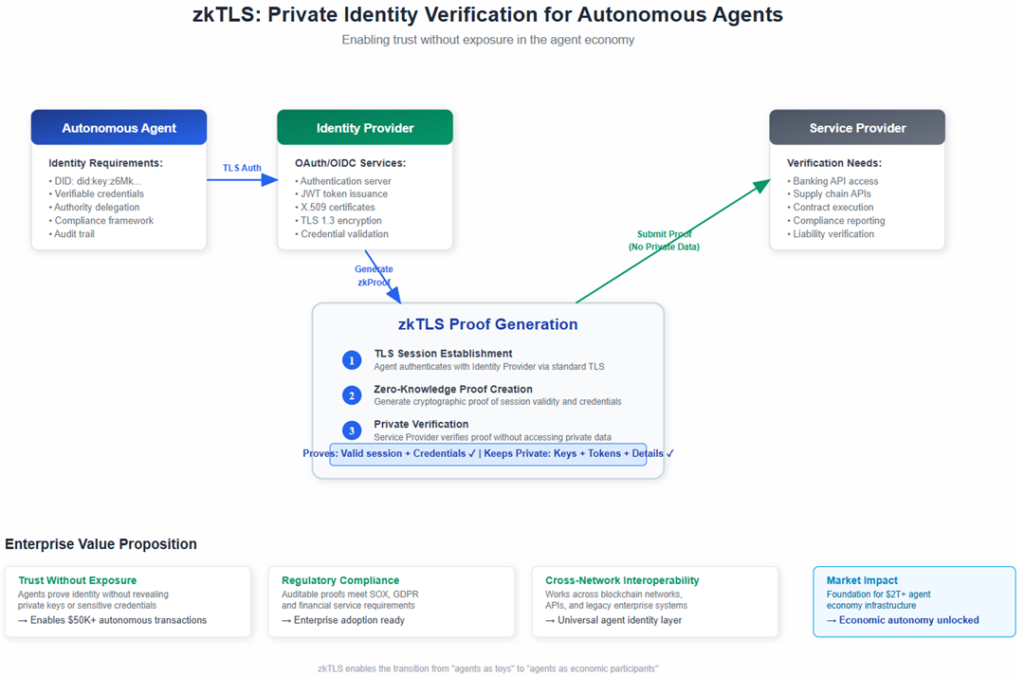

Why Identity Is the Unlock

I keep coming back to identity. Enterprise teams get excited about agents — until someone asks, “Who does this agent actually represent? Who’s liable if it screws up?” The excitement dies right there.

I’ve had this conversation dozens of times. Companies love the efficiency pitch: agents sourcing suppliers, negotiating contracts, managing inventory. Then reality hits. If an agent signs a $2M deal, who’s responsible? How do we prove it was authorized? What if it gets compromised?

It’s not a technical issue. It’s identity.

In human systems, we solve this with signatures, reporting structures, and contracts. When you hire someone, you check references and verify credentials. When a bank transfers $100k, there are identity checks at every step. We verify who’s acting on whose behalf. We establish authority and traceability.

Agents have none of that.

No persistent identity.

No verifiable credentials.

No reputation history.

No audit trail.

Without these foundations, agents can’t be trusted to do anything that matters. They’re stuck booking meetings and summarizing PDFs — not signing deals, spending funds, or making real decisions.

Identity is what turns agents from toys into participants.

That means:

- Decentralized identifiers (DIDs) for persistent identity

- Verifiable credentials (VCs) for authority and capability

- Reputation systems for accountability

- Compliance frameworks for traceability

Technologies like zkTLS enable all of this — private, verifiable authentication that works across networks without leaking keys or credentials. It’s like HTTPS for agents: programmable, composable, encrypted by default.

Once agents have an identity, the next question becomes obvious: How do they transact?

What unlocks real autonomy isn’t just thinking, it’s the ability to hold assets, make payments, and enforce transactions.

That requires a native medium of exchange: programmable, permissionless, and machine-native. That medium is crypto.

The Currency of AI Is Crypto

Once you solve identity, the next problem becomes obvious: how do agents transact? As AI agents begin to operate independently, crypto becomes their native medium of exchange. We’re on the verge of a massive surge in machine-generated output, far beyond what humans alone can produce. As agents begin to trade value, coordinate tasks, and secure data on-chain, economic productivity could decouple from population growth. As CZ recently noted, global GDP may no longer be tied to people. It may be driven by autonomous agents.

We need to build for that reality.

The Missing Layer: Identity, Payments, and Coordination

To be real economic participants, agents need infrastructure. Not just models or interfaces, but foundational layers that mirror human economic primitives:

- Identity Layer: DIDs and verifiable credentials for authentication and reputation

- Agent Wallets: Permissioned wallets with scoped authority and policy constraints

- Reputation Systems: On-chain interaction history, success rates, and trust metrics

- Programmable Payments: Smart contract-based escrow, streaming, micropayments, and milestones

- Interaction Protocols: Standardized agent-to-agent protocols for negotiation, retries, and task handoffs

- Compliant Offramps: Fiat bridges and stablecoin rails with embedded compliance hooks

This isn’t middleware. It’s economic infrastructure, composable, agent-native rails for identity, execution, and trust.

Big Tech is racing to productize agents, but they’re all focused on control, not autonomy.

Google is building the interface layer. OpenAI is building memory and custom tools. Anthropic is building safety. Adept is training agents to use software like humans. Inflection wants your personal AI.

These are real systems, and prove agents aren’t a fad. But none of them are building the economic stack. They aren’t building identity, wallets, trust layers, or payment rails.

That’s the missing piece. We don’t need another orchestration framework. We need economic infrastructure that enables agents to participate in markets, not just simulate conversations. Until we build that, they’re not autonomous.

Expanding the Stack: Where Blockchain/Crypto Fits and What Still Needs to Be Built

Web3/Blockchain is not the entire solution, but it is the critical missing layer for enabling autonomous agents to transact, coordinate, and operate trustlessly.

What Blockchain Enables Today:

- Interoperability (Decentralized AI-to-AI Communication): Enables agents to interact directly, share data, and coordinate actions without centralized APIs or trusted intermediaries

- Identity and Trust (On-Chain Agent Authentication): Gives agents cryptographic identifiers and verifiable credentials, allowing them to prove who they are, enforce policy-based access, and build a reputation over time

- Smart Contracts (Workflow Automation): Agents can trigger conditional payments, manage escrow, and coordinate workflows through programmable, enforceable contracts

- Agent-to-Agent Payments: Crypto-native systems like RUSD/XRPL, Circle USDC, PYUSD, and Solana enable real-time, low-fee micropayments between autonomous agents

- Decentralized Compute Rentals: Marketplaces like io.net and Gensyn let agents rent GPU compute on demand, priced and paid per usage

- Verifiable Identity and Reputation: Tools like DIDs, VCs, and zkTLS (via Primus) ensure agent interactions are secure, auditable, and compliant without leaking private data

- Data and Knowledge Marketplaces: Protocols like Ocean enable agents to subscribe to data feeds, purchase AI-ready datasets, or contribute knowledge to a shared network

Why Blockchain Is the Only Path to Real Autonomy

I want to reemphasize that we aren’t just talking about another AI agent stack. Those are focused on cognition, planning, and orchestration, and they’ve been dissected endlessly. What’s missing is the economic layer and interaction layer.

We are talking about infrastructure that enables autonomous participation, not just smart agents, but agents that can authenticate, transact, and coordinate in trust-minimized environments. That means identity, programmable payments, and verifiable execution. And that’s where blockchain fits.

Blockchain enables critical infrastructure that traditional systems can’t match:

- Smart Contracts: Enforceable, trustless execution of agreements

- Wallets: Native agent identity with transaction history

- Programmability: Rule-based automation and conditional logic

- Composability: Modular systems that interoperate permissionlessly

- Auditability: Transparent, verifiable interactions across trust boundaries

Several top innovative companies are tackling this:

- Primus: A cryptographic infrastructure platform that facilitates secure, privacy-preserving data verification and computation across Web2 and Web3 ecosystems. Leveraging technologies like zkTLS and zkFHE, Primus enables agents to authenticate identities, verify data integrity, and perform confidential computations without compromising privacy.

- Kite.AI: A decentralized Layer 1 blockchain platform that democratizes access to AI assets, including data, models, and agents through verifiable attribution, programmable governance, and autonomous payments.

- 0G (Zero Gravity): High-throughput, AI-native data availability layer designed for fast, verifiable access to models, memory, and multi-modal agent data

- Pin AI: Personalized AI – Lightweight compute with programmable wallets

- Sahara AI: Decentralized platform for building, training, and monetizing AI models and datasets, enabling agents to access private model inference and high-quality data across domains

- AMMO AI: Symbiotic layer: agent-native marketplaces and coordination protocols

- Morpheus: ZK-inference layer for verifiable agent decision-making without revealing model internals

- Fluence: Decentralized compute and coordination layer for peer-to-peer agent execution

- Synapse: Cross-chain messaging and bridging layer for agent-to-agent coordination across networks

- Fetch.ai: On-chain economic agents

- Ocean Protocol: Decentralized data exchange

- Gensyn: Token-incentivized compute

- Autonolas: Decentralized multi-agent coordination

- Prime Intellect: Decentralized training infrastructure for AI models

- Parry: Connective infrastructure that enables agents to reason, pay, store memory, and securely interact on-chain and off-chain

- Forte: Open-source Rules and ZK Policy Engines for compliant, risk-aware, and trustworthy digital economies. Empowers agents to operate within guardrails, manage risk, prove identity, and transact privately in decentralized systems.

- Sentient: Builds autonomous AI agents that interact with on-chain financial protocols. Agents analyze markets, deploy capital, and earn yield across DeFi, showcasing autonomous execution in real-world economies.

- Bittensor: Decentralized machine learning network rewarding models for serving high-quality information. Provides the cognitive substrate for agents through open, incentivized model sharing.

- Hyperbolic: Open-source orchestration layer for autonomous agents. Enables modular, permissionless task chaining and safety for complex multi-agent coordination.

These aren’t applications. They’re foundational layers that make real systems possible. But infrastructure alone doesn’t create ecosystems. It needs to be usable.

That’s where middleware matters. Not as a product strategy, but as a bridge. In the early days, infrastructure teams often built their own tools, not as platforms, but because someone had to make the system usable.

It’s the same reason game engine developers ended up building level editors, asset pipelines, and physics tools. They didn’t set out to build game studios. They just needed to show what their engine could do.

Middleware Is Not Enough

Infrastructure alone doesn’t scale ecosystems. The Internet didn’t scale on TCP/IP. It needed web servers, APIs, and browsers. Agents need the same.

Middleware turns primitives into platforms, not by becoming a full-stack solution, but by making composable systems usable. Routing frameworks, policy modules, and developer tools matter when they reveal the power of the underlying infrastructure. That’s the point. Tools should reduce friction, not create more of it.

Middleware is critical, not because it replaces infrastructure, but because it reveals what the infrastructure makes possible.

Real-World Use Cases (Beyond the Hype)

Forget the demos. Here’s what agents could do with the right infrastructure.

Agents managing procurement and supply chains with smart contract enforcement. Compliance agents verify documents before releasing payments. Customer service agents are responsible for managing spending limits, enforcing policies, and resolving disputes. Autonomous bidders in compute marketplaces like Gensyn or io.net. Data agents subscribing to streams, storing and selling insights are paid by other agents.

All of this is possible. However, this is only possible if agents have identity, programmable money, and a trust framework in place.

Build the Agent Economy

Picture this: It’s 2027. Your procurement agent wakes up, checks inventory levels, and discovers you’re running low on semiconductors. It queries the global supply network, not Google, but a mesh of other agents representing suppliers worldwide.

Within seconds, it’s negotiating with three supplier agents. Agent A offers the best price but has a 2% defect rate, as indicated by blockchain reputation data. Agent B costs 15% more but has never missed a delivery. Agent C is new, but they offer innovative terms and put money in escrow as a sign of trust.

Your agent weighs the options against your company’s risk profile and budget constraints. It executes a split order 70% from Agent B, 30% from Agent C to test the new supplier. Smart contracts automatically handle escrow, delivery confirmation, and payment release.

The entire transaction happens in minutes. No humans involved. No email chains, RFPs, or purchase orders. Just autonomous software making economic decisions on behalf of humans and organizations.

This isn’t science fiction. The technology exists today.

What’s missing is the infrastructure to make it trustworthy, compliant, and scalable. We need identity systems that let agents prove who they represent. Payment rails that allow them to transact without human intervention. Reputation systems that let them build trust over time.

The teams building this aren’t just shipping tools — they’re laying the foundation of a new economy.

An economy where productivity isn’t constrained by human bandwidth. Where commerce happens at software speed. Where algorithms, not employees, may power trillion-dollar companies.

The race is on. Google wants to own the agent interface. OpenAI wants to own the intelligence layer. However, the real prize is the economic infrastructure, the systems that transform agents from passive tools into autonomous actors.

And it all starts with identity.

Identity is the gateway to autonomy. It’s what turns agents from toys into participants. It lets them prove, transact, coordinate, and build trust, not just run tasks.

The next users of the internet won’t be people. They’ll be software. And they need infrastructure that treats them as first-class economic actors, not fancy toys.

This is the foundation of a new economy.

Not built by one company. Built by an ecosystem of builders who understand what’s at stake.

Let’s build it together, and in the open.